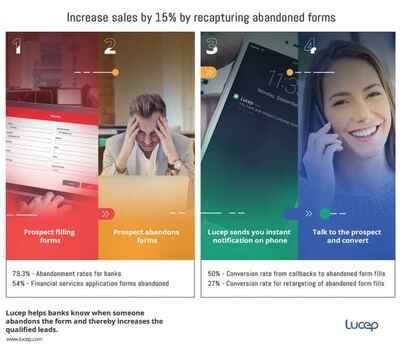

The abandonment rates for banks, at 79.3%, is way higher than other sectors such as retail (73.9%) and fashion (68.3%). More worrying is the fact that even the form abandonment rates for the financial sector are way too high. Research data from Forrestor shows that 54% of financial services application form fills are abandoned before completion.

So now you need two answers. First, how do you minimize these form abandonment statistics? Secondly, how do you identify and contact all these potential customers who abandoned forms on your website?

It’s a UX issue that can be fixed if you have the data. For example, Lucep gives you an instant notification and the option to call back the person who filled up the form. You’ll get instant notifications even when someone abandons a form after filling it up partially.

This is all you have to do to capture, call and convert abandoned form fills into customers:

1. Create GDPR compliant web forms using Lucep.

2. Customize to capture real-time data from forms.

3. Convert abandoned form fills through retargeting and callbacks.

If you do this, the leads generated from form fills on your website will increase by at least 15%.

UX tweaks to reduce abandoned form fills

The conversion rates for abandoned forms using the above method is sweet, but you don’t really want people to leave your website after partially filling up a form. You want them to complete it and hit submit.

Analysis of abandoned forms shows where users are leaving, and will tell you what’s wrong with the form. For banking and financial services, one of the key dropoffs happens when you ask for sensitive documents and personal data that people don’t remember.

Rather than get their documents and share it online, they prefer to abandon the form, and get it done later offline.

Here’s a webinar video (see screenshot below) from Avoka which cites Forrestor data about “Solving the Buy Problem.”

The problem they’re trying to highlight is that, when it comes to banking and financial services, it’s a lot harder to make digital channel leads buy online right away. They prefer to do their research online, and complete the purchase (online or offline) only after an offline interaction.

To get past the security barrier to form fills, you have to provide some kind of reassurance at the right field where you’re asking for personal data and documents. Have a “Why do we need this” link that opens in a lightbox next to the field. It should clearly explain that banking regulations require you to collect this data, and explicitly state how the data will be used.

Also enable auto form-fills using browser data, a feature that makes it easier and faster to fill up forms with an absolute minimum of typing effort. If it’s a long form that requires pages of data to be filled in, it might be advisable to make it a multi-page form with a progress indicator that tells people how much more is left.

Go Omnichannel to help customers complete website forms

The problem, as stated above, is that people have a trust issue when it comes to sharing financial and personal data online. They need reassurance offline, in between the time when they see the form and then actually fill it up. In fact, it works perfectly if you have someone on the phone talking to you while you’re filling up the form.

This needs an omnichannel banking solution that can track customer journeys, starting from web forms to the phone, email and back on phone, and then back to the web form.

So a customer starts filling out a web form. They abandon it, and your product specialist related to that form gets the real-time notification and call the person back instantly. After a discussion of the product and clarification of doubts, the product specialist sends an email with a secure payment link that opens up the same form – partially completed.

The customer, seeing his own data already filled in and having talked to the bank rep in person, now feels confident enough to complete the form and buy the product online.