As a digital transformation enabler, Lucep eliminates the need for banks to maintain large branches with huge square footage set aside for waiting customers. Customers arrive just in time for their scheduled appointment, and get the services they require without having to wait in line. This is one of our key selling points – the cost savings from smaller branches that actually provide a better customer experience.

Save Bank Branch Costs. Click here for Callback. Get an Estimate Now

![reduce-bank-branch-costs]()

reduce bank branch costsIt’s kind of a big deal, since banks typically pay 15-20 percent above the market per square foot of real estate they rent, compared to other retail outlets. In 10 to 20 years, that adds up into a lot of money.

This is why we study our client branch locations and the scaling plans for their physical branch networks, so we can give them an estimate of the massive amount in costs saved once they start using our software.

A trend we’re bumping into is that there’s a bit of a contradiction in this, because expansion into new markets requires the opening of new branches, but digital transformation renders these branches obsolete even before they’re opened.

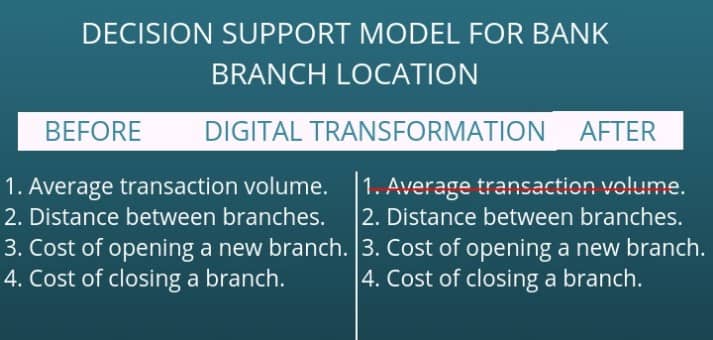

That brings up the question of the criteria for new branch locations, and their design and the services to be provided. In this post, you’re going to read the traditional criteria for bank branch site selection, which is now a bit outdated. Then we’ll take a look at the new decision support model for bank branch location, taking into account your digital transformation plans.

Decision support models for traditional bank branch location

There are many studies that provide detailed criteria and decision support models for bank branch location (Boufounou, Abbasi, Zhao et al., Nihan Cinar; Manandhar and Tang; Cook et al.; Camanho and Dyson, Ferhan Cebi & Zeynel Zeren; Ayfer Başar, Özgür Kabak, Y. İlker Topçu, etc.)

I’m going to focus on the last one, because this study actually led to a mathematical model that was used to pick the best branch locations for a national bank in Istanbul, Turkey. This is the list of site selection criteria they mention, based on research and study of other reports:

– Population and demographic (growth rate, avg houshold size, age, gender, etc.)

– Financial indicators (domestic per capita income)

– Customer segmentation (socioeconomic, cultural, income level, trade potential, etc.)

– Competitors (total deposits, number of branches, number of firms, etc.)

– Location of competitor branches and easement of access

– Average transaction volume

– Proximity to own existing branches

– Cost of opening and closing branches

Based on interviews with experts and survey questionnaires, the study authors (Ayfer Basar, Ozgur Kabak, Y. Ilker Topcu) decided that the following are the most important criteria for bank branch location.

1. Average transaction volume.

2. Distance between branches.

3. Cost of opening a new branch.

4. Cost of closing a branch.

Bank Branch Location Criteria after Digital Transformatio

banking kioskWith ATMs, self-service kiosks, net banking, mobile banking and other channels being activated, your branches don’t have to be located or designed for transactions. With the first of 4 criteria eliminated, what’s left is the distance between branches and the cost of opening and closing existing branches.

Based on interactions with clients and branch transformation heads of the world’s top banks, we can tell you what the branch is for, and will be used for over the short- and long-term.

Question: What is your vision for the future of branch banking? What kind of branches do you see 5, 10, 20 years down the line?

Mr. Hui Hui Li, Evergrowing Bank: “Physical branches will still exist but their functions will evolve. No matter how technologies are developing, customers will have more faith and trusts on the banks when they see physical branches nearby. However, the branch will be transformed from “transaction or service center” into an “experience center.”

We also have a whitepaper that explores bank branch models that will be popular in future. It shows that your branch will either be a:

1. Lounge for attracting high-value clients and providing them personalized service;

2. A digital pod that serves as a hub for all the digital technologies that your customers must use; or

3. A pharmacy-style branch that provides all the services you provide.

In summary, the decision support model for bank branch location is no longer about transactions, your competition and real estate investments. It’s a small space with signage, essential staff and a technology hub (if not completely automated) that reinforces customer loyalty and branding.

People see their bank on the way to work, on their way to the market, and on the way back home. They come occasionally, to open accounts and discuss complex financial products or urgent needs that cannot be fulfilled online or on the phone.

So you must have a visible physical presence near all your customers (distance between branches), but it doesn’t necessarily need a large real estate investment to accommodate hundreds of customers (cost of closing a branch). You can scale it down to a space for 5-10 customers at most (cost of opening a new branch).

This is how we help our clients do branch transformation, through customer identification, segmentation, omnichannel engagement, and appointment scheduling that frees up the need to maintain large branches. So you can go digital without shutting down the branches.